Singapore’s entrepreneurial landscape is often praised for its clarity of regulation, strong intellectual property protections, and fast market access across Southeast Asia—advantages that also benefit women founders. The city-state’s compact size belies a dense ecosystem where capital, mentorship, and infrastructure sit within a few subway stops. For women building companies, this proximity shortens feedback loops: accelerators, co-working spaces, and investor meetings can happen within the same day, fueling faster iteration and smarter risk-taking.

Government-linked platforms play a central role. Enterprise Singapore and Startup SG offer grants, capability development programs, and internationalization support that many female founders cite as critical scaffolding in the early stages. NUS Enterprise and the BLOCK71 network extend further reach through community events, soft-landing hubs, and connections to overseas partners. Meanwhile, the Action Community for Entrepreneurship (ACE) and various corporate innovation labs operate as conveners, frequently featuring women-led panels and pitch days that normalize female leadership in high-growth sectors.

Yet structural gaps persist. Access to venture capital remains uneven, shaped by pattern-matching biases and smaller networks in late-stage funding. Women founders often report being steered toward “safer” business models or questioned more intensely on risk than their male counterparts. This is where women-centric networks add momentum: organizations and communities like CRIB, She Loves Tech (Singapore chapter), and SG Women in Tech foster mentorship, visibility, and peer learning that compound over time.

Talent is a decisive advantage. Singapore’s education system produces engineering, finance, and design graduates who are globally competitive; the workforce is multinational and mobile. Women entrepreneurs are increasingly tapping this talent pool to build cross-functional teams and to pilot products in a market that is digitally mature, affluent, and demanding—ideal conditions for refining user experience and monetization models. Corporate partnerships are especially potent in Singapore, where large enterprises frequently run pilot programs with startups and can offer distribution, compliance expertise, and credibility.

Work-life design remains a practical consideration. Founders often balance family responsibilities with the intensity of startup life, making flexible arrangements, reliable childcare, and social support essential. Progressive companies in Singapore are experimenting with remote-first teams, compressed work weeks, or outcome-based contracting—innovations that tend to expand opportunity for women in leadership.

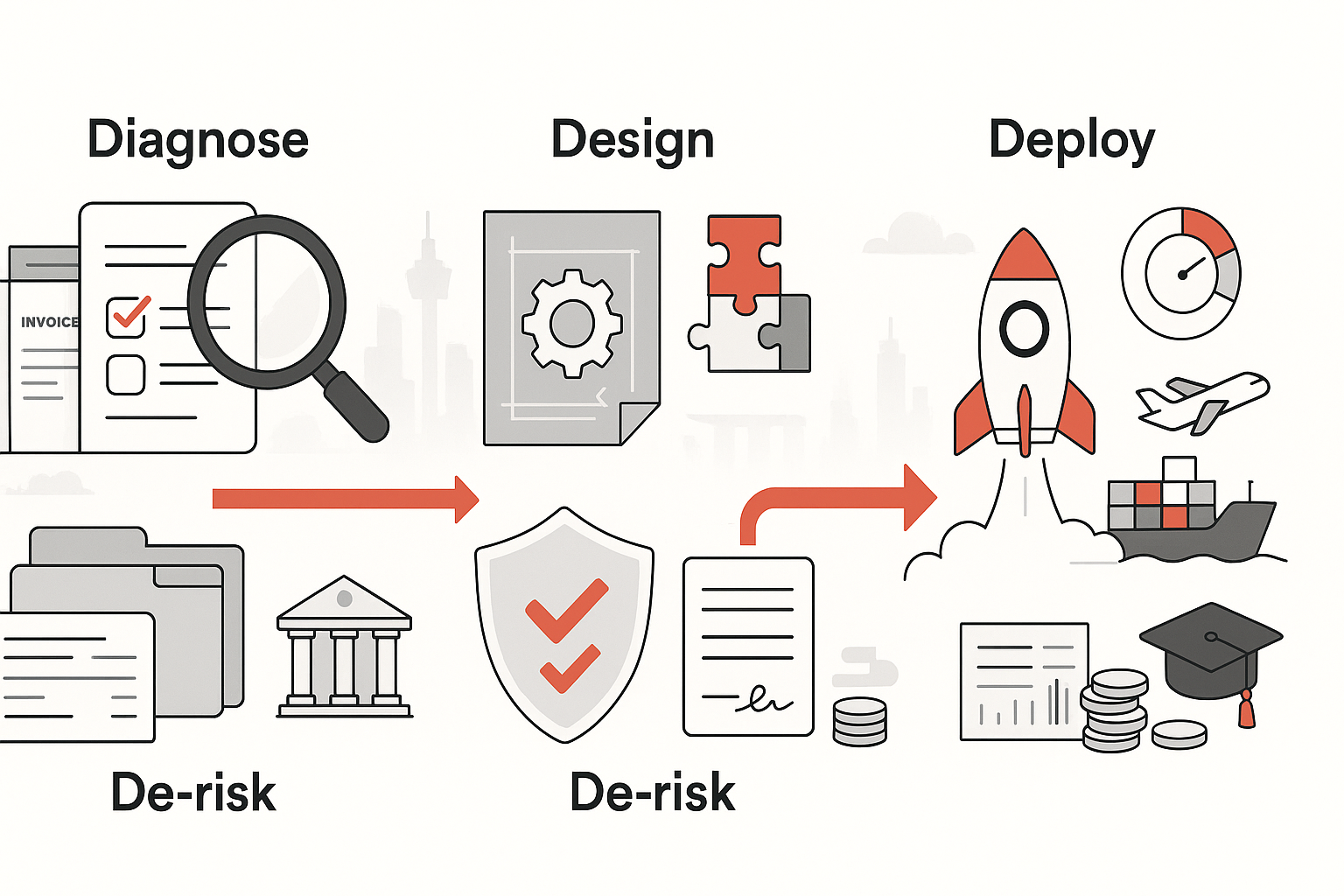

Looking ahead, three levers stand out. First, targeted capital—funds that explicitly back women-led ventures—can accelerate parity in later-stage rounds. Second, public procurement with inclusion criteria could unlock significant demand and validate women-owned suppliers. Third, regional expansion playbooks tailored for ASEAN markets would help founders replicate success beyond Singapore. The city-state has laid a sturdy foundation; the next phase is about scaling visibility, capital access, and market depth so that women entrepreneurs not only start companies at equal rates, but also exit them with comparable outcomes.